At the conclusion of the Global Fintech Fest 2024, Google has announced a range of innovative features for Google Pay, aimed at enhancing user convenience and expanding digital payment capabilities in India.

The tech giant has partnered with the National Payments Corporation of India (NPCI) to introduce several new functionalities, including UPI Circle, eRupi, and Clickpay QR scan for bill payments, which are set to roll out later this year.

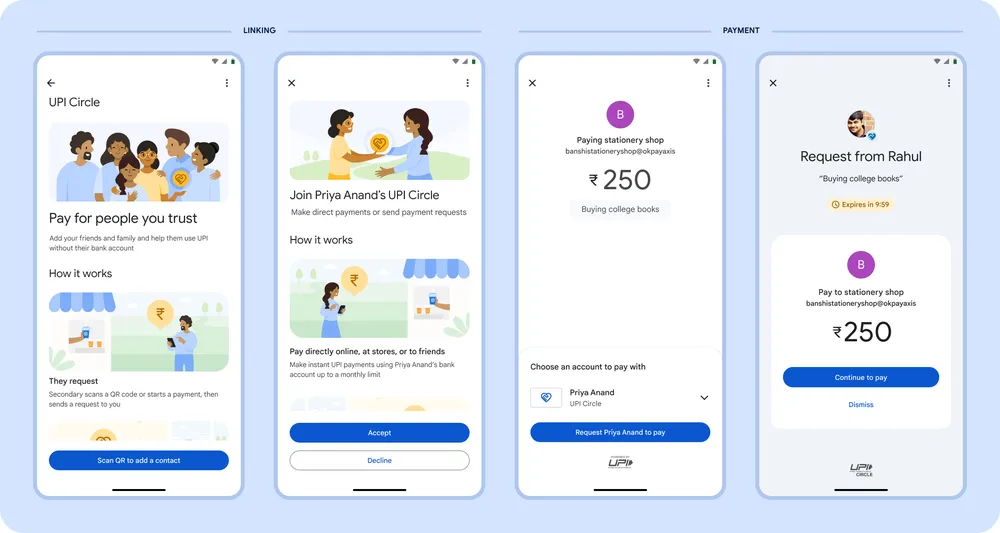

UPI Circle: Simplified Transactions for Trusted Contacts

Google Pay’s new UPI Circle feature, developed in collaboration with the National Payments Corporation of India (NPCI), will allow users to extend digital payment capabilities to their trusted contacts without requiring them to link their own bank accounts.

This feature is designed to increase accessibility and ease of use for individuals who may be hesitant to adopt digital payments.

Users can delegate payment capabilities to their contacts with a monthly limit of up to INR 15,000, choosing between partial or full delegation options.

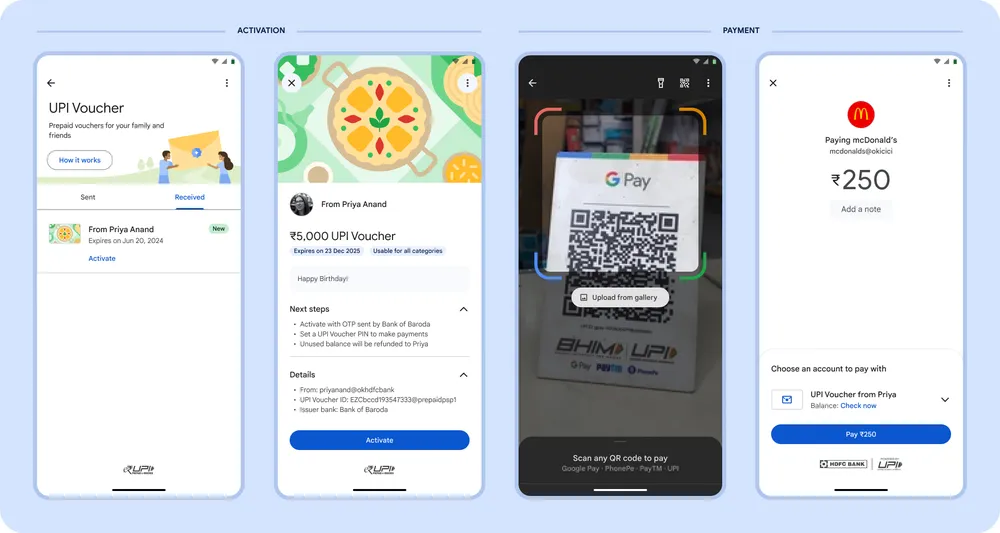

UPI Vouchers or eRupi

In an effort to broaden the scope of digital payments, Google Pay is integrating UPI vouchers, or eRupi, into its app.

This feature allows users to make transactions using prepaid vouchers linked to their mobile numbers, without needing to link their bank accounts.

Originally introduced for COVID-19 vaccination payments, eRupi has been expanded to support a variety of merchant transactions, making digital payments more inclusive.

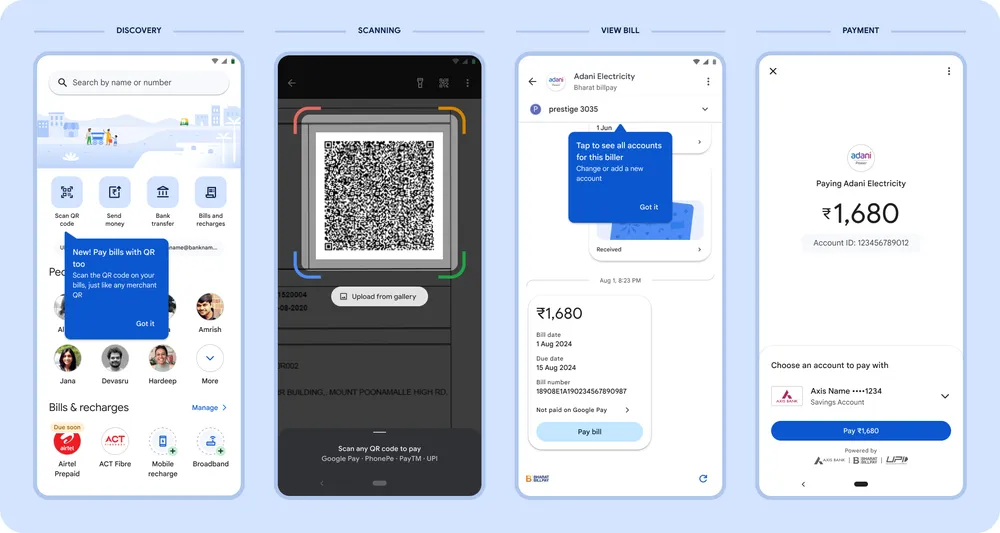

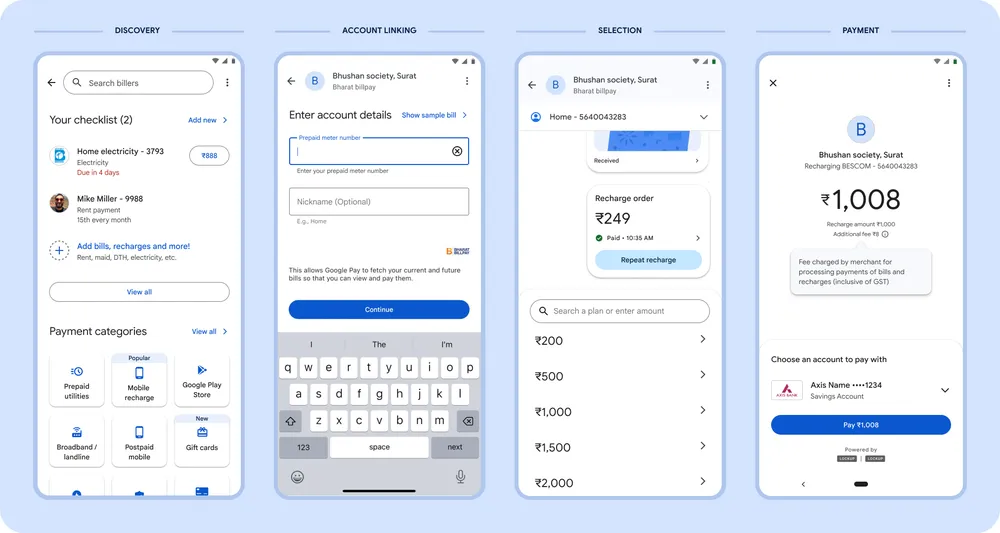

Streamlined Bill Payments with ClickPay QR

To simplify online bill payments, Google Pay has partnered with NPCI Bharat BillPay to support ClickPay QR codes.

Users can now pay their bills by scanning a QR code with their existing QR scanner.

This new feature eliminates the need for remembering lengthy account details, automatically fetching the latest bill for a seamless payment experience.

Prepaid Utilities Payment Feature

Google Pay is also rolling out a new feature called Prepaid Utilities, designed to help users manage their recurring payments.

This feature, developed in collaboration with NPCI Bharat BillPay, allows users to track and pay their prepaid utility bills through a single checklist on the Google Pay app, offering greater convenience and organization.

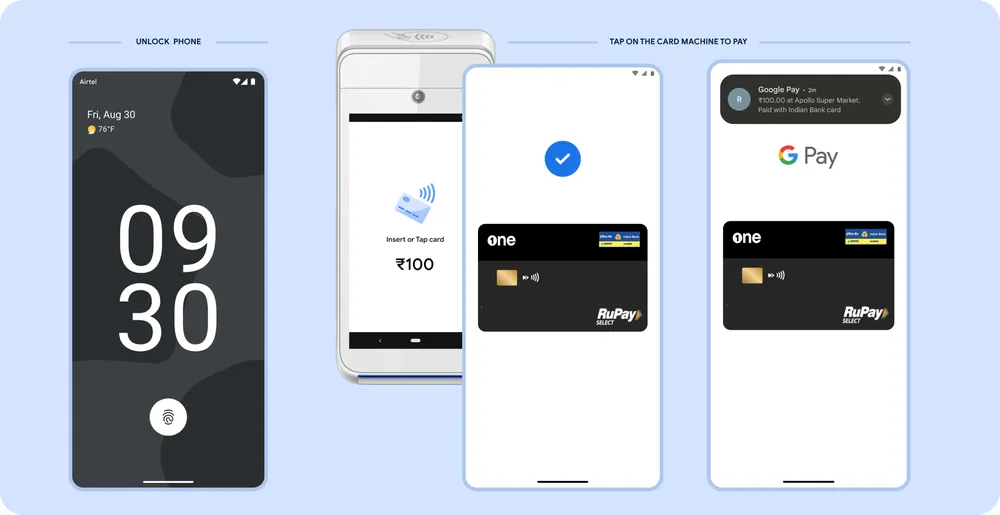

Tap & Pay with RuPay Cards

Expanding its contactless payment options, Google Pay is introducing Tap & Pay functionality for RuPay cards.

Users can add their RuPay cards to Google Pay and make payments by simply tapping their mobile phones at card machines.

This feature enhances payment security and convenience, as card information is not stored on the device.

Autopay for UPI Lite

Google Pay is also enhancing the UPI Lite experience with the introduction of Autopay.

This feature will enable automatic top-ups to a user’s UPI Lite wallet when the balance falls below a specified amount, ensuring uninterrupted access to small ticket purchases and transfers.

Market Dynamics: Competing in a Growing Fintech Space

The announcement comes at a time when competition in the fintech sector is intensifying.

Rivals like Paytm, PhonePe, and CRED are expanding their offerings to capture a larger share of the market.

PhonePe, for instance, recently introduced a credit line on UPI and a pre-approved term life insurance feature.

CRED has launched a new feature for monitoring bank account balances and managing recurring payments.

Google Pay and PhonePe dominate the UPI ecosystem, holding a near duopoly.

As of July, PhonePe had a market share of 48.3%, while Google Pay held 37%.

PhonePe recorded 6.98 billion transactions amounting to INR 10.28 lakh crore last month, compared to Google Pay’s 5.34 billion transactions worth INR 7.35 lakh crore.

Paytm followed with 1.12 billion transactions totaling INR 1.23 lakh crore.

With these new features, Google Pay aims to further solidify its position in the competitive digital payments landscape, catering to the evolving needs of its user base and enhancing the overall payment experience.