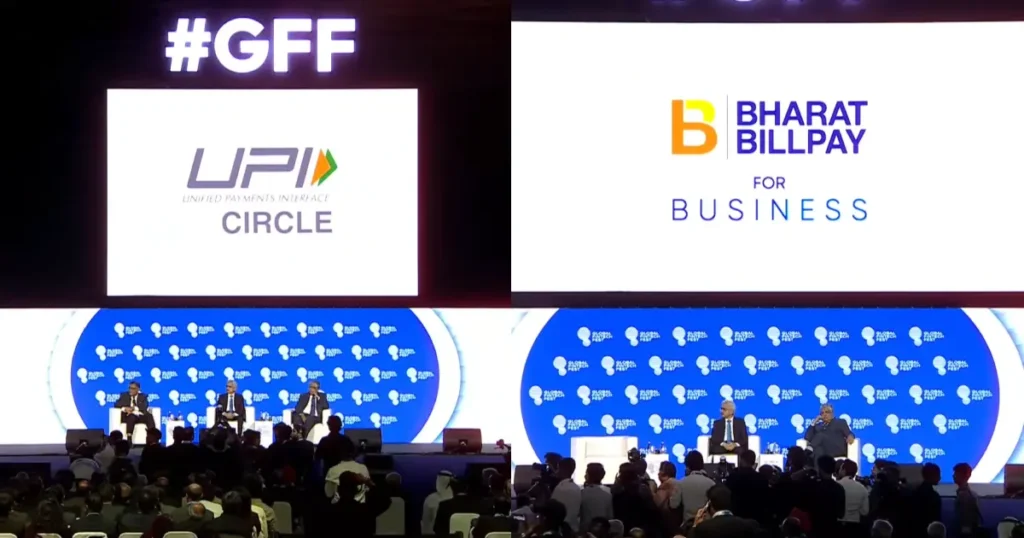

The Reserve Bank of India (RBI) Governor, Shaktikanta Das, yesterday on August 28 announced the launch of two groundbreaking fintech products, UPI Circle and Bharat BillPay for Business (BBPS), during the opening session of the Global Fintech Festival 2024.

Developed by the National Payments Corporation of India (NPCI), these innovative solutions are poised to enhance the inclusivity, security, and efficiency of India’s rapidly growing digital payment ecosystem.

UPI Circle: Simplifying Payment Delegation

UPI Circle is a new feature that allows users to delegate their payment responsibilities to trusted secondary users within the UPI app.

This feature is designed to make digital payments more convenient, particularly in situations where the primary user may not be able to initiate transactions themselves.

Under the full delegation mode, a primary user can authorize a trusted secondary user to initiate and complete transactions on their behalf, with a cap of INR 15,000 per month and a single transaction limit of INR 5,000.

The partial delegation mode allows the secondary user to initiate payment requests, which must be approved by the primary user using their UPI PIN.

A primary user can delegate payments to up to five secondary users, while a secondary user can only accept delegation from one primary user.

BBPS for Business: Streamlining B2B Payments

The RBI also introduced Bharat BillPay for Business, an extension of the existing Bharat Bill Payment System (BBPS) designed specifically for businesses of all sizes.

This new offering aims to simplify B2B payments and collections by providing a centralized, interoperable platform for managing various invoicing and payment processes.

BBPS for Business offers a suite of services, including business onboarding, purchase order creation, invoice management, automated reminders, guaranteed settlement, financing options, and online dispute resolution.

The platform promises to bring efficiency and transparency to business operations by automating manual processes and offering seamless integration with banks, ERP platforms, and B2B fintechs.

Fintech Innovations on Display

The Global Fintech Festival 2024 witnessed a flurry of innovations, including the launch of a co-branded credit card by Flipkart’s fintech app super.money in partnership with Utkarsh Small Finance Bank.

Additionally, the RBI approved the Fintech Association for Consumer Empowerment’s (FACE) application to become a self-regulatory organization for the fintech sector, further underscoring the central bank’s commitment to fostering a secure and innovative digital payment environment.