Insurance is an essential safety net for individuals and businesses, providing financial protection against unforeseen events.

However, navigating the complexities of insurance claims can be daunting, especially when facing issues such as claim rejection, delays, or mis-selling.

Claim rejections and delays can happen in various sectors, including life insurance, general insurance, and health insurance.

Mis-selling of insurance, where customers are misled into buying policies under false pretences, adds another layer of complexity and mistrust.

This situation not only affects the financial stability of policyholders but also undermines the integrity of the insurance industry.

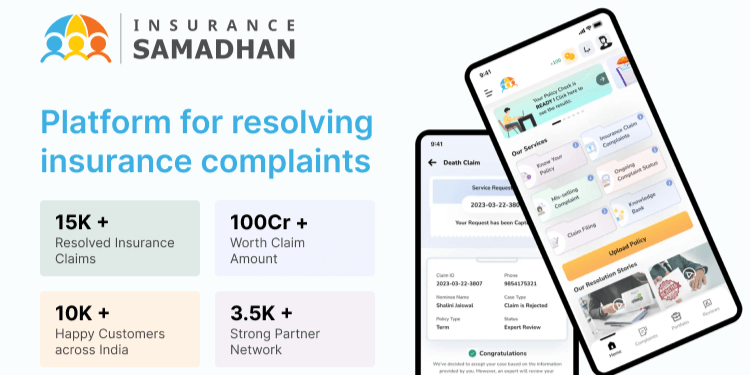

Addressing these challenges is Insurance Samadhan, a platform dedicated to resolving insurance complaints. Their mission is to empower aggrieved policyholders by ensuring they receive rightful insurance claims or refunds of premiums.

By focusing on these issues, Insurance Samadhan aims to restore trust in the insurance sector and ensure policyholders are treated fairly and transparently.

Insurance Samadhan was founded by a team of five passionate individuals, Deepak Bhuvneshwari Uniyal, Shilpa Arora, Ravi Mathur, Sanjay Aggrawal, Shailesh Kumar.

With over 100 years of combined experience in the insurance and legal industry, the team’s diverse skills and experiences enable them to effectively address and resolve insurance-related grievances.

Insurance Samadhan offers a range of services to address common issues faced by policyholders.

These include assisting with claim rejections, delays in claim processing, and instances of insurance mis-selling.

Their “Know Your Policy” feature helps customers identify errors or mistakes in policy documents, such as incorrect declaration of health conditions or nominee details.

This comprehensive approach ensures that policyholders are well-supported in navigating the often complex insurance landscape.

The process of resolving complaints with Insurance Samadhan is streamlined and customer-centric. It begins with the submission of a complaint form, followed by sharing relevant case documents.

After a thorough review, the case is accepted, and a nominal one-time registration fee of INR 500 is charged. The resolution of the complaint then follows, for which Insurance Samadhan charges a success fee of 12% plus GST, only upon successful resolution.

This fee structure underscores their commitment to resolving cases effectively.

By addressing critical issues such as claim rejections, delays, and mis-selling, Insurance Samadhan not only assist individual policyholders but also work towards improving the overall standards and transparency of the insurance sector.

Their approach could pave the way for more customer-centric practices in the industry, ultimately leading to greater trust and reliability in insurance services.