Bajaj Housing Finance has submitted preliminary papers with the Securities and Exchange Board of India (SEBI) to raise ₹7,000 crore through an initial public offering (IPO).

The IPO consists of a fresh issue of equity shares worth ₹4,000 crore and an offer for sale of equity shares worth ₹3,000 crore by its parent company, Bajaj Finance, as per the draft red herring prospectus.

The share sale is part of an effort to comply with the Reserve Bank of India’s (RBI) regulations, which mandate that upper-layer non-banking financial companies (NBFCs) must be listed on stock exchanges by September 2025.

The proceeds from the fresh issue will be utilized to bolster Bajaj Housing Finance’s capital base, ensuring it can meet future capital requirements.

Established in September 2015, Bajaj Housing Finance is a non-deposit-taking housing finance company registered with the National Housing Bank.

It offers a range of financial solutions, including home loans, loans against property, lease rental discounting, and developer financing for both residential and commercial properties. The company has been designated as an ‘upper layer’ NBFC by the RBI.

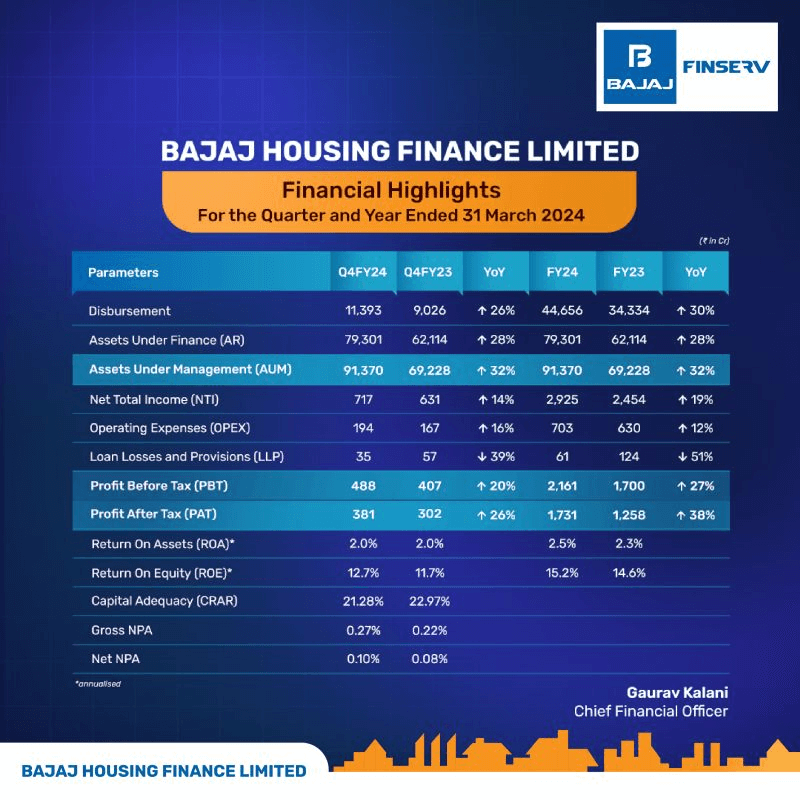

In the financial year 2023-24, Bajaj Housing Finance reported a net profit of ₹1,731 crore, reflecting a 38% increase from ₹1,258 crore in the previous fiscal year.

This growth underscores the company’s robust financial performance and strong market presence.

The IPO is managed by a consortium of leading financial institutions, including Kotak Mahindra Capital Company Ltd, BofA Securities India Ltd, Axis Capital Limited, Goldman Sachs (India) Securities Private Ltd, SBI Capital Markets Ltd, and JM Financial Ltd and IIFL Securities Limited.

This move follows the recent listings of other housing finance companies like Aadhar Housing Finance and India Shelter Finance on the stock exchanges.

On June 6, the board of Bajaj Finance approved the sale of shares worth ₹3,000 crore in Bajaj Housing Finance’s upcoming IPO, marking a significant step towards fulfilling regulatory requirements and enhancing the company’s financial capabilities.