Zoho Corporation, the Chennai based SaaS giant led by Sridhar Vembu, has announced its entry into the payments space with the launch of Zoho Payments.

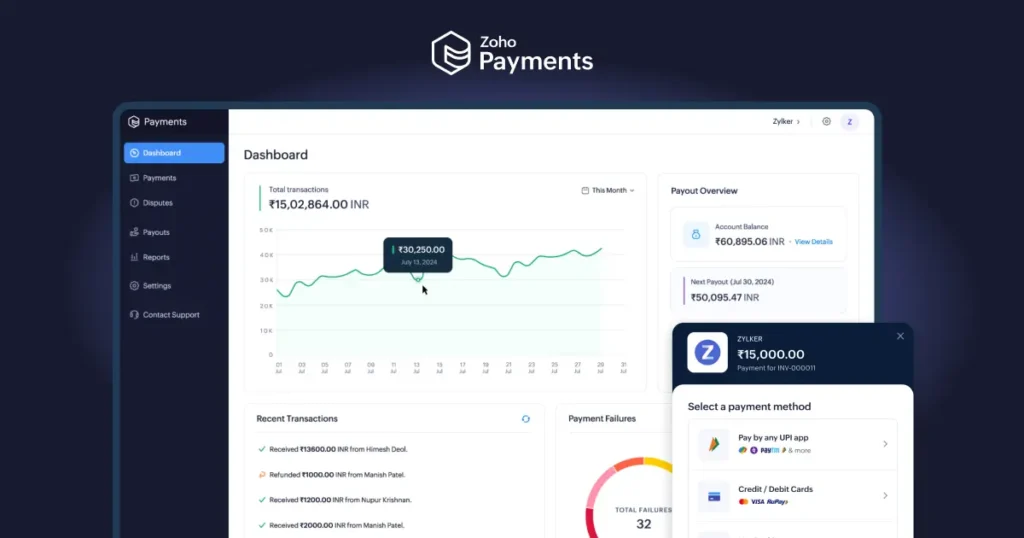

This new service is designed to facilitate seamless business to business (B2B) transactions, enabling businesses to receive payments through various methods, including UPI, net banking, and cards.

Zoho Payments integrates seamlessly with Zoho’s existing suite of finance and operations applications such as Zoho Books, Zoho Invoice, and Zoho Billing.

According to the company, this integration aims to streamline payment processes and enhance overall operational efficiency for businesses.

The B2B payments capabilities of Zoho Payments are powered by the Bharat Bill Payment System (BBPS) of NPCI Bharat BillPay Limited (NBBL).

Zoho secured a payment aggregator license from the Reserve Bank of India (RBI) in February, allowing it to offer this new service.

“At Zoho, we strongly believe that business finance, banking, and payments should work together,” said Sivaramakrishnan Iswaran, Global Head of Finance and Operations BU at Zoho.

“Towards this vision, we had launched our ‘Connected Banking’ solution across our finance apps, integrating with leading banks. With the launch of Zoho Payments today, along with B2B payment capabilities, we are able to achieve our goal. NBBL’s BBPS standardises invoice presentment and payments, providing multiple payment modes, instant payment confirmations, invoice financing, and a unified platform for invoice transmission and reconciliation. This marks a major advancement in the fintech domain. As a result, we can now offer a more holistic financial management solution for businesses.” Sivaramakrishnan Iswaran added.

The BBPS platform standardizes invoice presentment and payments, offering businesses multiple payment modes, instant payment confirmations, invoice financing, and a unified platform for invoice transmission and reconciliation.

This advancement in the fintech domain is expected to significantly benefit businesses looking for streamlined financial management solutions.

This development follows Zoho’s recent foray into the retail sector with the launch of Zakya, a new business division offering POS solutions designed to enhance inventory management, omnichannel sales, and customer experience.

Zoho’s expansion into the payments space is part of its ongoing diversification strategy.

Last year, the company introduced Zoho Practice, an end to end practice management solution for chartered accountants, and also launched Ulaa, a privacy centric web browser aimed at securing personal data.

Founded in 1996 by Padma Shri awardee Sridhar Vembu and Tony Thomas, Zoho has grown into a global SaaS leader with offices in the US, Singapore, the UAE, and Japan.

The company offers over 50 integrated online applications supporting various business functions, including sales, marketing, finance, email, and collaboration.

On the financial front, Zoho’s revenue surpassed the $1 billion mark in the financial year ending March 31, 2023, with operating revenue increasing by 30% year-on-year.

Despite the revenue growth, the company also reported a significant rise in total expenditure, reflecting its continued investment in expansion and innovation.