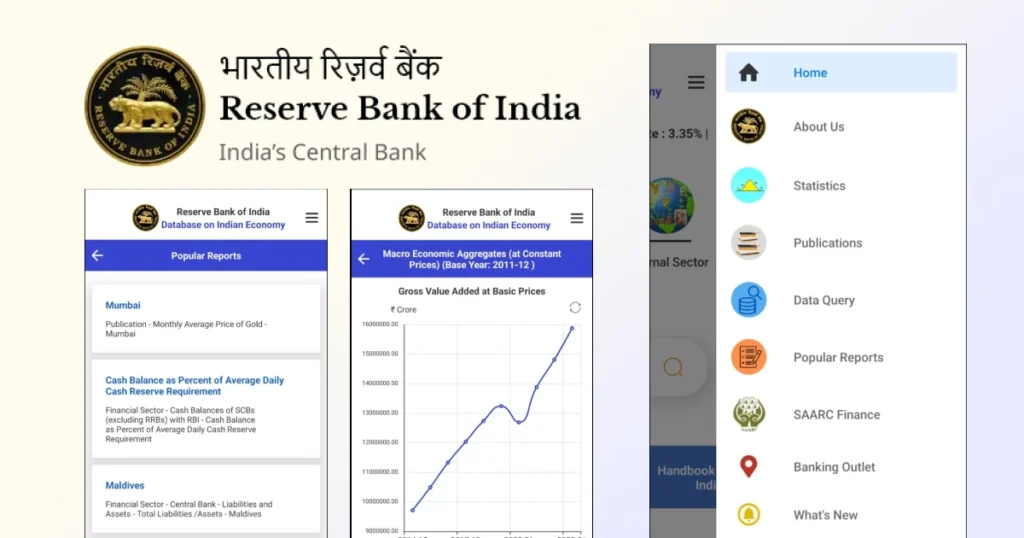

The Reserve Bank of India (RBI) has launched a new mobile application, RBIDATA, designed to provide users with macroeconomic and financial statistics related to the Indian economy in a user-friendly and visually engaging manner.

The app offers access to over 11,000 different economic data series, allowing researchers, students, and the general public to gain a comprehensive view of India’s economic landscape.

Users can visualize time series data through graphs and charts, as well as download data for further analysis.

Key Features of RBIDATA

- Extensive Data Access: Over 11,000 economic data series are available.

- Interactive Visuals: Users can view data in graph and chart formats.

- Detailed Metadata: Each dataset includes information on the data source, unit of measurement, frequency, and latest updates, along with additional explanatory notes.

- Popular Reports: A section featuring frequently accessed reports for quick reference.

- Efficient Search Function: A built-in search feature enables users to access data directly from the home screen.

- Banking Outlet Locator: Helps users find banking facilities within a 20 km radius.

- Regional Data: Access to economic data from SAARC countries through the ‘SAARC Finance’ section.

- Direct DBIE Portal Access: Quick access to RBI’s Database on the Indian Economy (DBIE – https://data.rbi.org.in).

- Feedback Mechanism: Users can provide suggestions to enhance the app’s functionality.

The RBIDATA mobile app is available for both iOS and Android users (version 12 and above), ensuring accessibility across various devices.

The RBI aims to make economic data more accessible to policymakers, analysts, academicians, and the general public through this initiative.

With its extensive database and user-centric features, RBIDATA is set to become an essential tool for anyone looking to explore India’s financial and economic data in an intuitive and efficient manner.

Digital Security and Financial Innovation

The launch of RBIDATA aligns with RBI’s broader initiatives aimed at improving financial transparency and security.

Earlier this month, the central bank introduced an exclusive internet domain, ‘bank.in’, dedicated to Indian banks.

This initiative is designed to mitigate cybersecurity threats, such as phishing and malicious attacks, ensuring a safer online banking experience.

The Institute for Development and Research in Banking Technology (IDRBT) will serve as the exclusive registrar, with domain registrations commencing in April 2025.

Furthermore, during its last Monetary Policy Committee (MPC) meeting on December 6, 2024, the RBI introduced MuleHunter.AI, an artificial intelligence and machine learning-powered model for detecting mule bank accounts.

This system aims to enhance fraud detection capabilities within the banking sector.