Shares of electric two-wheeler manufacturer Ola Electric experienced a significant rally during their debut trading session today, marking a strong entry into the stock market.

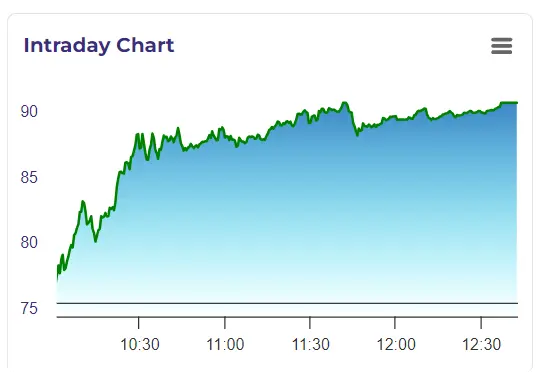

Opening at INR 76 the company’s shares soared to an intraday high of INR INR 91.20, representing a remarkable 20% increase from the listing price of INR 76 on the National Stock Exchange (NSE).

The surge comes after a muted debut, with Ola Electric’s shares opening at INR 76 per share.

The company’s market capitalization now stands at approximately INR 40,226 crore, underscoring robust investor interest and confidence in its future prospects.

Ola Electric’s initial public offering (IPO) closed three days ago, having been significantly oversubscribed.

The public issue saw a demand of 198.79 crore shares against the 46.51 crore shares on offer, reflecting a strong 4.27X oversubscription.

The IPO included a fresh issue of shares worth INR 5,500 crore and an offer-for-sale (OFS) of 8.49 crore shares, ultimately raising over INR 6,145.6 crore.

The positive momentum in Ola Electric’s stock is a sharp contrast to the company’s financial challenges.

For the fiscal year 2023-24, Ola Electric reported a widened net loss of INR 1,584 crore, up 7.6% from the previous year’s INR 1,472 crore.

Nonetheless, the company saw a substantial increase in operating revenue, which jumped over 90% to INR 5,009 crore from INR 2,630 crore in FY23.

Analysts had mixed views on the IPO.

They expressed optimism about Ola Electric’s future, highlighting its ambition to become a comprehensive player in the EV sector with advanced technology and infrastructure.

However, they also noted the company’s current losses at the operational level.

The successful debut and subsequent price rally reflect strong market sentiment towards Ola Electric’s growth strategy and its role in the expanding EV market.