Go Digit General Insurance Limited, one of India’s prominent new-age insurance companies, has unveiled its 10th Transparency Report, titled “Navigating the Time Vortex in Insurance Realm.”

This bi-annual report, which had taken a brief hiatus due to the company’s IPO process, offers a comprehensive look at various time-related metrics crucial to the insurance sector.

The report highlights key turnaround times (TATs) across different insurance categories such as health, motor, travel, and home insurance.

Notably, the average TAT for health insurance cashless pre-authorization was 25.58 minutes, with the fastest approval clocking in at just 3 minutes 37 seconds.

Hospital discharge approvals averaged 54 minutes, while reimbursement claims were settled in an average of 3.15 days, with the quickest at 12.59 hours.

Motor insurance saw an average work approval time of 15.4 hours, with the fastest approval in 5 minutes.

Claims settlement times averaged 16 days, with fastest motor claims being settled in as little as 20 minutes for four-wheelers and 31 minutes for two-wheelers.

In travel insurance, 82% of claims were processed via automation, with non-medical domestic claims settled in under 24 hours.

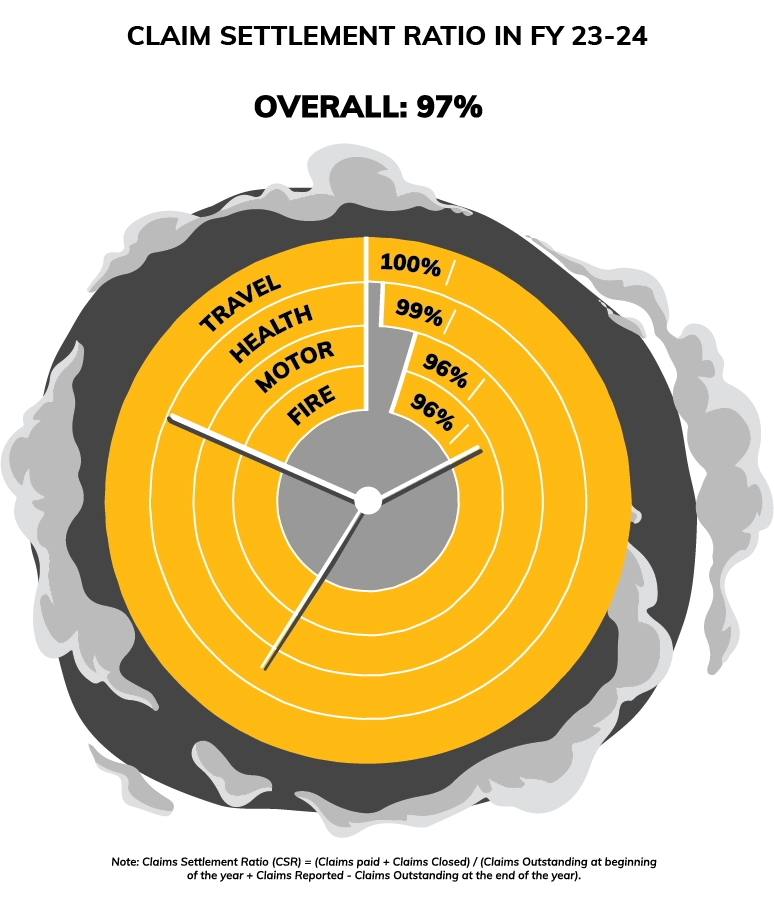

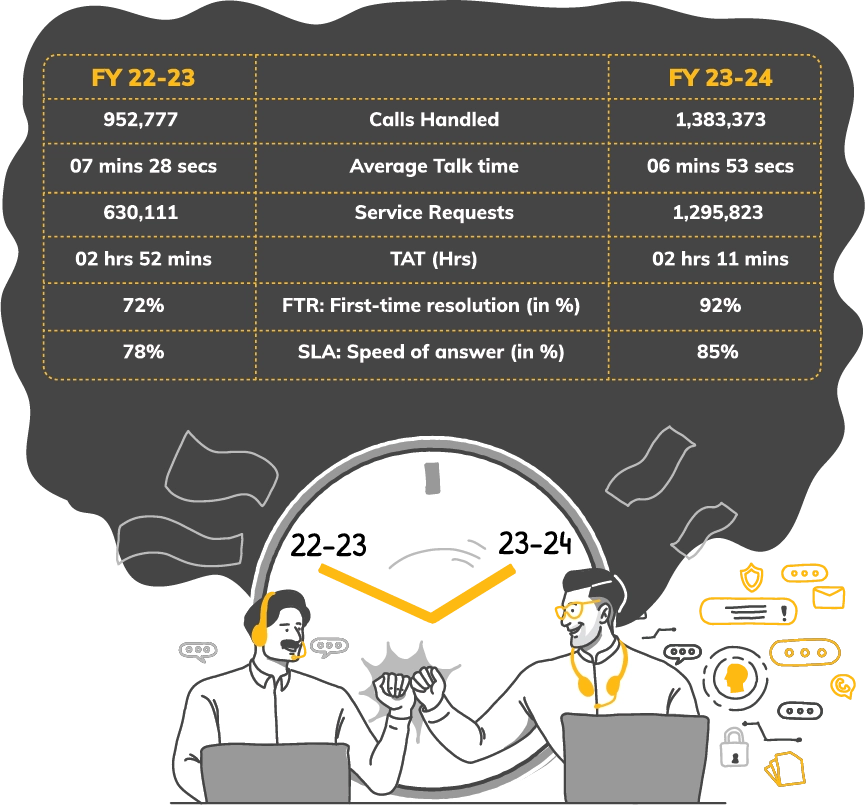

The company reported a claims settlement ratio of 97% for FY 23-24, with its Customer Happiness Team handling 1.3 million calls, a 45% increase year-on-year. Impressively, 92% of customer queries were resolved on the first call.

Financially, Digit Insurance experienced significant growth, with gross written premiums reaching $1.1 billion (₹90.2 billion), a 24.5% year-on-year increase.

The company sold 11.1 million policies and has served 47.1 million customers since its inception. Its motor insurance market share rose to 6%, contributing to an overall market share of 3.1%.

Tejas Saraf, Company Secretary & Compliance Officer of Go Digit General Insurance, emphasized the importance of transparency and the company’s commitment to minimizing customer wait times.

The report encapsulates Digit’s data-driven approach, technological advancements, and customer-centric strategies that have fueled its rapid ascent in the insurance sector.

About Digit Insurance:

Founded in 2016 by Kamesh Goyal, Go Digit General Insurance Limited leverages technology for innovative product design, distribution, and customer experience in non-life insurance.

The company offers a range of insurance products including motor, health, travel, property, and marine insurance.