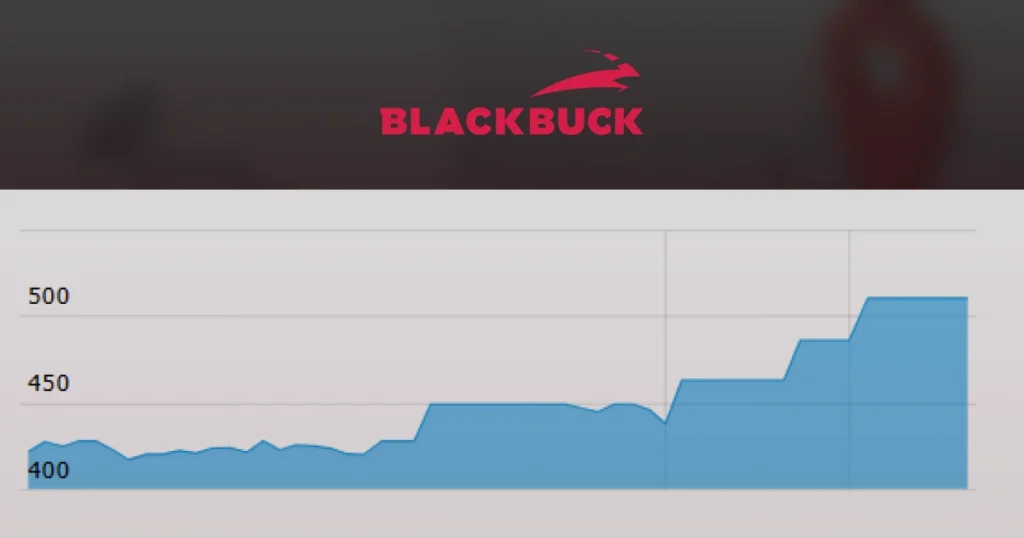

Shares of Zinka Logistics Solutions Ltd, the parent company of logistics giant BlackBuck, continued their upward trajectory, hitting the 5% upper circuit for the fifth straight session today.

Trading at INR 510.85 on the Bombay Stock Exchange (BSE), the stock surged from its previous close of INR 486.55 on February 7.

The company’s market capitalization has now reached INR 9,015 crore.

Q3 FY25 Financial Performance

BlackBuck’s stock rally commenced on February 4, just a day before the company unveiled its Q3 FY25 financial results.

Despite reporting a widened consolidated net loss of INR 48.03 crore, a 145% increase from INR 19.57 crore in the same period last year, investors remain optimistic about the company’s growth potential.

The losses were largely attributed to exceptional costs, including IPO expenses of INR 8.45 crore and share-based payment expenses totaling INR 69.44 crore.

However, the company’s operating revenue saw a robust 41% year-on-year increase, rising to INR 113.98 crore in Q3 FY25 from INR 80.86 crore in Q3 FY24.

Sequentially, the revenue climbed 15% from INR 98.77 crore in Q2 FY25.

One of the most notable financial highlights was the sharp surge in adjusted EBITDA, which skyrocketed 459% year-on-year to INR 42.04 crore, signaling strong operational efficiencies and improved cost management.

BlackBuck’s Business Evolution

Founded in 2015 by IIT Kharagpur alumni Rajesh Yabaji, Chanakya Hridaya, and Rama Subramaniam, BlackBuck started as a truck aggregation platform, facilitating inter-city full truckload (FTL) transportation.

Over the years, the company has pivoted to offering value-added services, including FASTag, fuel cards, vehicle tracking software, subscriptions, and loans.