The Reserve Bank of India (RBI) has officially recognised the Fintech Association for Consumer Empowerment (FACE) as a Self-Regulatory Organisation in the FinTech Sector (SRO-FT).

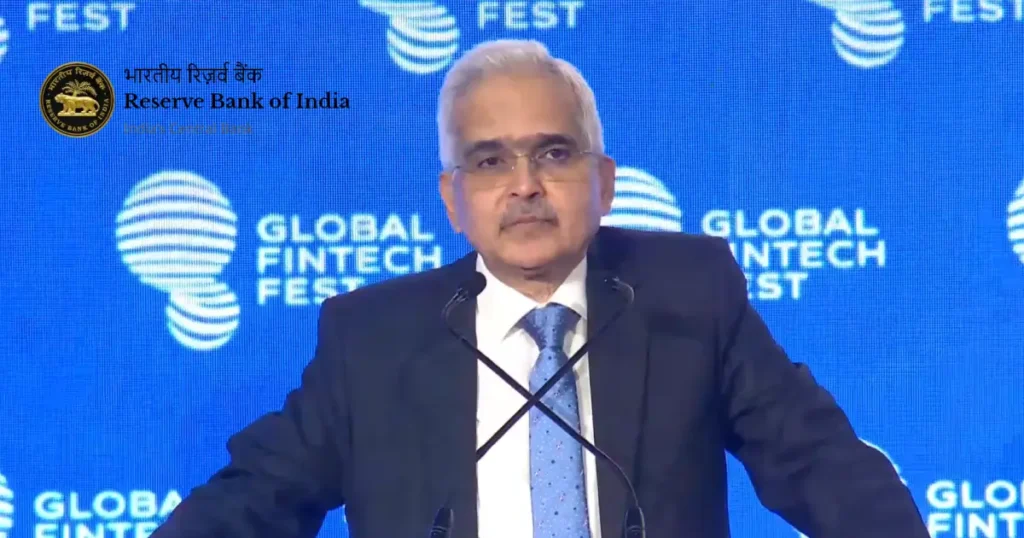

This landmark announcement was made by RBI Governor Shaktikanta Das at the Global Fintech Fest (GFF) on 28th of August.

Governor Shaktikanta Das revealed that the RBI had received applications from three industry entities for recognition as SROs.

Out of these, FACE was granted the prestigious recognition, marking a significant step forward in regulating and empowering the fintech ecosystem in India.

While one application was returned with a provision for resubmission after meeting certain requirements, the third application is still under review.

Speaking at the event, Shaktikanta Das emphasized the importance of SROs in the fintech landscape, stating, “Through regular consultations, feedback mechanisms, and policy dialogues, the SROs would facilitate open communication and enable fintechs to stay informed about regulatory expectations and priorities.”

FACE, which counts leading digital lending platforms such as CASHe, Fibe, CRED, Groww, and InCred among its members, claims to represent 80% of the digital lending business volumes in India.

As an SRO, FACE will serve as a critical interface between the fintech industry and the regulator, offering practical, effective, and stable recommendations to the RBI.

The RBI’s move to establish SROs follows the draft norms issued in January and the final guidelines notified in May this year. The initiative is part of the central bank’s broader strategy to foster a dynamic and well-regulated fintech sector.

In addition to discussing SROs, Governor Shaktikanta Das highlighted the potential for international cooperation in the development of central bank digital currencies (CBDCs).

With the CBDC pilot underway since December 2022, India has already demonstrated interoperability with retail payment systems like UPI and is exploring offline solutions and programmability features for targeted financial assistance.

Governor Shaktikanta Das also underscored the RBI’s commitment to deepening the country’s digital public infrastructure (DPI), which includes frameworks like Aadhaar, UPI, and other targeted payment solutions.

These initiatives are expected to enhance the overall efficiency and efficacy of India’s financial system.

The recognition of FACE as an SRO marks a significant milestone in the evolution of India’s fintech sector, setting the stage for enhanced regulatory collaboration and innovation.